Investment grade wine

Less than 1% of wines produced globally are considered investment-grade — bottles so renowned for quality, demand, and track record that they can grow in value over time.

Learn more below 👇

If you're after a specific wine for your collection. Request a wine →

📈 Why invest in wine

- Tangible asset, historically resilient

- Enjoyment value (you can literally drink your investment)

- Diversifies portfolios

- Low correlation with property and stock markets

A timeliness collectible like art & cars

Wine is part of an asset class called collectibles - think fine art, cars, handbags and watches - and over the past decade it's been one of the best performing.

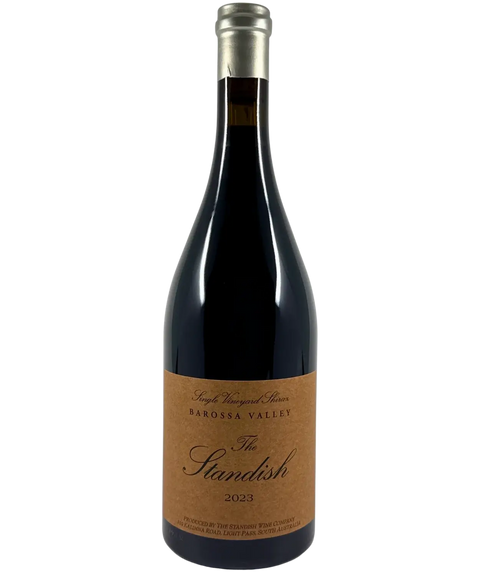

44 products

Buy Investment-Grade Wine in Australia

Frequently asked questions

What makes a wine investment-grade?

Is wine a good investment in Australia?

Why do some wines increase in value over time?

How is wine an alternative asset class?

What are the best wine investments for beginners?

How do you resell investment wine in Australia?

How important is wine provenance for investment value?

What are the risks of wine investment?

Should I drink my investment wines or keep them sealed?

How do I build a wine investment portfolio?

What's the difference between buying wine investment bottles direct versus at auction?

How do you authenticate and store investment wine properly?